The recent California wildfires have wreaked havoc on the insurance industry, significantly affecting the mortgage industry and highlighting the importance of Wildfire Insurance. On February 3, 2025, National Mortgage News reported that approximately $11B of outstanding mortgage debt on homes in Los Angeles, California are affected by the 2025 wildfires. Needless to say, that is a very large problem and a large amount of money. Compounding the already tragic, disastrous fires that ravaged these communities, homeowners must make vital decisions about the future of their houses, none of which are easy decisions. As evacuation orders are removed and residents return, many homeowners are starting the complex process of deciding whether to rebuild or pursue other options going forward – the financial factors are making the decisions rather difficult for some people.

The availability of property insurance payouts, as well as the financial commitments associated with current mortgages, including Wildfire Insurance, have a significant impact on these decisions. For many homeowners, the depth of their insurance coverage, particularly in light of current escalating rebuilding costs, will be critical in determining their capacity to reconstruct their houses. Outstanding mortgage balances will probably also complicate the decision-making process for many people, as lenders have a vested stake in how insurance payments are allocated by both contract and statute.

Given ever-increasing construction prices, regulatory concerns, and personal financial conditions, some homeowners may choose to rebuild in a new area (if they can afford to), while others may contemplate selling the site or pursuing other financial restructuring measures. The loan balance on an existing mortgage, and the amount of insurance proceeds available to the homeowner will both be determining factors going forward. As the region recovers, homeowners will need clear legal and financial assistance and strategic planning to manage these complex issues.

“Is Your Home Truly Protected? Unpacking the Hidden Insurance Rules in Your Fannie Mae/Freddie Mac Mortgage, Note and Deed of Trust!”

The conventional Fannie Mae/Freddie Mac Note and Deed of Trust includes particular insurance terms intended to protect both the borrower and the lender in the event of property damage or loss. These measures guarantee that the lender’s security interest in the property is protected. The primary insurance criteria often include:

1. Mandatory Property Insurance Coverage

As long as there is a loan balance attached to real property, the borrower must keep hazard insurance on the property, which covers hazards such as fire, windstorm, and other common perils.

Coverage must be at least equivalent to the loan’s unpaid principal balance or the full replacement cost of property renovations. The typical Fannie Mae/Freddie Mac Deed of Trust in California includes provisions for property insurance in paragraph 5. Section (a) of paragraph 5 requires the borrower to get insurance in the types and quantities specified by the lender for “improvements now existing or subsequently erected on” the secured property. Section (b) of paragraph 5 mandates that this property insurance includes a “standard mortgage clause” that “must name Lender as mortgagee.” The standard mortgage provision in a homeowner property insurance policy is significant because it establishes, by law, an independent or separate contract of insurance between the lender and the insurer for the amount of secured debt. This distinct contract requires the insurer to add the mortgagee (lender or bank) named on the policy as a payee on certain insurance money checks, and failure to do so may result in responsibility for the insurer.

The typical homeowner insurance policy will generally cover the following types of losses: the dwelling, other structures (such as a detached garage or pool house), additional living expenditures (known as fair rental value under FAIR plan plans), and personal property. The mortgagee clause of the homeowner policy, as well as the language of the Deed of Trust, will require the mortgagee to be named as a payee for insurance proceeds issued under the house or other structures coverage. According to Paragraph 5(d) of the standard Deed of Trust, the Lender may hold insurance proceeds pending inspection of the property and then disburse the money to the borrower in a single payment or a series of payments as work advances. If an insurer mistakenly names a mortgagee as a payee on insurance proceeds checks for additional living expenses or personal property, the mortgagee should endorse the check and return it to the borrower. The mortgagee should not hold funds for personal property or additional living expenditures. Importantly, the property hazard insurance must be issued by a lender-approved insurer.

2. How are Insurance Proceeds to be Utilized?

According to section (d) of paragraph 5 of the Deed of Trust, insurance payments “will be applied to restoration or repair of the Property, if Lender deems the restoration or repair to be economically feasible and determines that Lender’s security will not be lessened by such restoration or repair.” There is no guidance in the Deed of Trust and very little case law interpreting the term “economically feasible” or considering under what conditions the “Lenders’ security will not be lessened by such restoration or repair.” California case law recognizes that whether the Lender’s security is reduced or damaged is subject to a requirement of good faith and fair dealing.

If the Lender determines, subject to the duty of good faith and fair dealing, that repair or restoration is not economically feasible or the Lender’s security is impaired or would be lessened, then the insurance proceeds “will be applied in the order that Partial Payments are applied in paragraph 2, section (b) as follows: interest and then to principal due under the Note, Escrow Items, late charges, any other amounts then due under Deed of Trust, and then to reduce principal. “Deed of Trust” section 2(b). Property insurance only covers the value of improvements (including personal property), and it does not cover the value of the land that is being insured. This is a crucial point to keep in mind. The proceeds from property insurance are not intended to satisfy the mortgage, and it is possible that they will not be adequate to satisfy a mortgage in its entirety. This is due to the fact that the land itself constitutes a component of the value of the secured property.

3. What are the Lender’s Interest and Rights in Insurance Proceeds?

The lender is named as the “loss payee” or “mortgagee” on the insurance policy, indicating that they have a primary financial stake in the property and are the first party to receive insurance payments in the event of damage or loss. This designation protects the lender’s investment by requiring that any cash paid out under the insurance policy be used to settle outstanding loan commitments before any remaining amount is released to the borrower. This structure reduces the lender’s financial risk while protecting their secured interest in the property.

If the property receives partial damage, such as from a fire, storm, or other covered risk, the insurance payout is usually used to support essential repairs or restoration. However, the lender retains the ability to decide if the property’s value and security interest are still intact before permitting the borrower to proceed with renovations. In many situations, the lender may require the borrower to utilize the insurance funds for repairs rather than keeping them, ensuring that the property remains in excellent shape and serves as appropriate collateral for the mortgage. The lender may also supervise the allocation of repair money, often releasing them in stages as work advances to ensure that repairs are completed appropriately.

In the event of a total loss—when the property is destroyed beyond repair—the lender may utilize the insurance proceeds to pay off or substantially decrease the outstanding mortgage obligation. This ensures that the lender is fully compensated even if the physical property is lost. However, if both the borrower and the lender agree, and the terms of the mortgage agreement and insurance policy allow it, the cash may be used to rebuild the property instead. This scenario is more likely if the borrower intends to restore the home while continuing to make mortgage payments, and if the lender determines that rebuilding is financially feasible and retains the value of the secured loan.

4. Lender’s Right to Forcibly Place Insurance

If the borrower fails to maintain the required insurance coverage on the mortgaged property, the lender reserves the right to obtain insurance on the borrower’s behalf, a practice known as “force-placed insurance” or “lender-placed insurance.” This measure is not optional for the borrower, as maintaining adequate property insurance is a standard requirement in virtually all mortgage agreements. Lenders implement this policy to safeguard their financial interest in the property, which serves as collateral for the loan. Without continuous insurance coverage, the lender’s investment would be at risk in the event of damage or destruction to the property.

Force-placed insurance is typically far more expensive than conventional homeowner’s insurance, often costing several times the price of a policy the borrower could obtain independently. The increased cost is due to several factors, including limited coverage options, higher risk assumptions by the insurer, and the lack of shopping around for competitive pricing. Unlike standard homeowner’s insurance, which typically protects both the borrower and the lender, force-placed insurance primarily benefits the lender. It ensures that the outstanding mortgage balance is covered in the event of a loss, but it may provide little to no protection for the borrower’s personal belongings or liability risks.

The cost of force-placed insurance is typically added to the borrower’s loan balance or assessed as a separate charge, significantly increasing the financial burden on the homeowner. In some cases, the lender may also impose administrative fees associated with procuring and managing the policy. Because of these added expenses, borrowers are strongly encouraged to maintain their own insurance coverage to avoid the imposition of force-placed insurance, which can lead to increased mortgage payments and potential financial hardship.

How does California Insurance Code Section 2051.5 Effect Los Angeles Fire Victim Homeowners?

California Insurance Code Section 2051.5 specifies how insurance claims for damaged or destroyed property should be handled, particularly in the context of partial and total losses. The law is intended to safeguard policyholders and provide fair recompense. Section 2051.5 has the following key requirements:

1. Calculate Claim Payouts

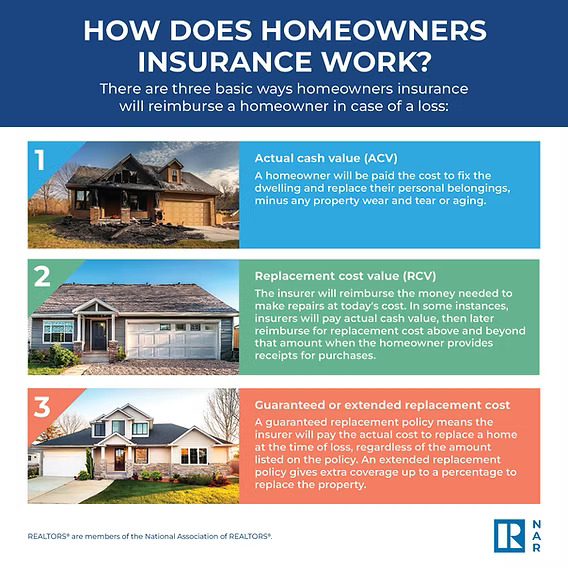

The section explains how insurers must compute reimbursements for partial and total losses, distinguishing between actual cash value (ACV) and replacement cost value (RCV). ACV represents the depreciated value of an item or property at the time of loss – It is calculated as: ACV = Replacement Cost – Depreciation. RCV represents the cost to replace or repair the damaged item or property with a new one of similar kind and quality, without deducting for depreciation. It is calculated as: RCV = Full Cost of Repair or Replacement.

For Partial Loss:

The insurance is responsible for the cost of repairing, restoring, or replacing the damaged piece of the property. Unless otherwise specified in the insurance, the payout is based on the replacement cost without depreciation.

For Total Loss:

If a property is declared a total loss, the insurer must pay the full policy maximum or the cost of replacing the property, whichever is lower. If the actual cost to reconstruct the home is greater than the policy limits the homeowner will have to come out-of-pocket to complete the construction. Additionally, insurers cannot subtract depreciation from the reimbursement if the policyholder decides to rebuild or replace the lost property.

2. Right to Replacement Cost Coverage

If the policy contains replacement cost coverage, the policyholder is entitled to reimbursement for the cost of rebuilding or replacing the destroyed property at today’s prices. Remember, if the actual cost to reconstruct the home exceeds policy limit the homeowner will have to come out-of-pocket to complete the construction. Importantly, insurers cannot order policyholders to rebuild on the same site; they may rebuild elsewhere provided they are not beholden to a Note and Deed of Trust tied to a specific piece of land.

3. Timeframe for Collecting the Full Replacement Cost

The insured has at least 24 months (which can be extended to 36 months in the event of delays beyond their control) to rebuild, replace, or purchase another property and claim the full replacement cost. This rule prohibits insurers from pressuring homeowners into making hasty decisions following a calamity.

4. Alternative Location for Building or Buying a New Home

Homeowners might use their insurance settlement to rebuild or buy a new property in a different place. The insurer cannot reduce the claim amount only because the new residence is in a different neighborhood. This is also subject to the Note Holder being completely paid in full on the original piece of land.

5. Personal Property Coverage

Personal property (such as furniture, clothing, and appliances) is also covered by replacement cost provisions, allowing policyholders to replace their belongings at current market prices rather than just getting depreciated value.

6. Protection Against Unfair Insurance Practices

Insurers cannot unfairly lower compensation by using excessive depreciation assumptions.

The law requires insurance companies to fulfill their duties to policyholders without imposing unwarranted restrictions or delays – doing so by the insurer could subject them to a Bad Faith claim.

What is the Impact of California Insurance Code Section 2051.5?

California Insurance Code Section 2051.5 has far-reaching ramifications for homeowners, insurers, and the broader real estate and insurance businesses. Its main impact is on consumer protection, fair compensation, and disaster recovery, especially in the aftermath of large calamities like wildfires, earthquakes, and other catastrophic events.

1. Increased Consumer Protection and Fair Payouts

Ensures that homeowners are compensated fairly for their losses and prevents insurers from underpaying claims due to excessive depreciation deductions. This also guarantees replacement cost coverage for repairs, reconstruction, or purchasing a new home, rather than simply compensating for depreciation (Actual Cash Value). Moreover, it prohibits insurers from placing onerous requirements, such as requiring homeowners to rebuild on the same site.

2. Financial Relief and Stability for Homeowners

This provision allows homeowners at least 24 months (up to 36 months in some situations) to rebuild or buy a new home, giving them financial freedom and avoiding hasty decisions. This section allows evacuated residents to relocate and rebuild in safer locales, lowering their vulnerability to future calamities, particularly in wildfire-prone regions (pending the mortgage amount assessment). Ensures that policyholders receive adequate compensation for personal property losses, allowing them to replace important items at full market value rather than depreciated value.

3. Improved Disaster Recovery Efforts

The law promotes community rebuilding and economic recovery in the aftermath of large-scale disasters by assuring timely and adequate payments. It also helps to keep homeowners from being financially stranded owing to insurance underpayments, lowering the risk of foreclosure or financial hardship. It also supports overall housing market stability by ensuring that insurance reimbursements match real rebuilding costs, avoiding underinsurance gaps that could stymie reconstruction efforts.

4. Increased Accountability for Insurance Companies

This code section forces insurers to use clear and equitable claim settlement methods, decreasing disputes over payout amounts. It sets explicit guidelines for how and when payments must be made, discouraging delays and bad faith techniques. Finally, it limits insurers from implementing restrictive policies that prioritize their financial interests over policyholders’ requirements.

5. Higher Costs for Insurers (and Possible Premium Increases)

The need that insurance companies pay full replacement costs (rather than depreciated values) raises their financial liabilities (which should be reflected in increased premiums for those policy holders). As insurers adjust for the additional financial load, high-risk locations may see higher homeowner’s insurance prices. Some insurance firms may choose to limit coverage availability or quit high-risk markets (for example, wildfire-prone areas), reducing policyholders’ alternatives. There are several large insurance companies and underwriters who have stopped writing policies in California and Florida for that matter.

6. Impact on Housing and Real Estate Markets

Homeowners are better prepared to recover and rebuild, reducing abandoned properties and blight in disaster-stricken communities. This hopefully allows homeowners to migrate without incurring financial penalties, thus causing population changes away from high-risk locations – again this depends on the balance due on the mortgage. Ultimately this may raise the cost of owning in California as higher insurance rates are factored into property bills – and even homebuyers qualifying for their loans.

Should the Cost of Rebuilding a House Surpass the Replacement Cost Coverage Insurance Policy Limits is the Insurer Obliged to Finish Construction?

A replacement cost coverage insurance policy does not cover reconstruction costs that exceed the policy’s limits, even if the actual cost of rebuilding exceeds those limits. Replacement Cost Coverage in a Total Loss Scenario is limited to the policy’s stated limit. This is a lesson for consumers wanting to skimp on having a low value on their insurance policy. Every homeowner reading this should make an appointment with their insurance broker to evaluate their current policy and determine if increasing the policy limits to conform with today’s construction costs.

If the policyholder did not obtain enough coverage to cover current building expenses (for example, due to increased labor and material costs), they may not get enough monies to rebuild completely. This is typical in locations where building expenses are rapidly rising or following natural disasters that raise demand for contractors and materials.

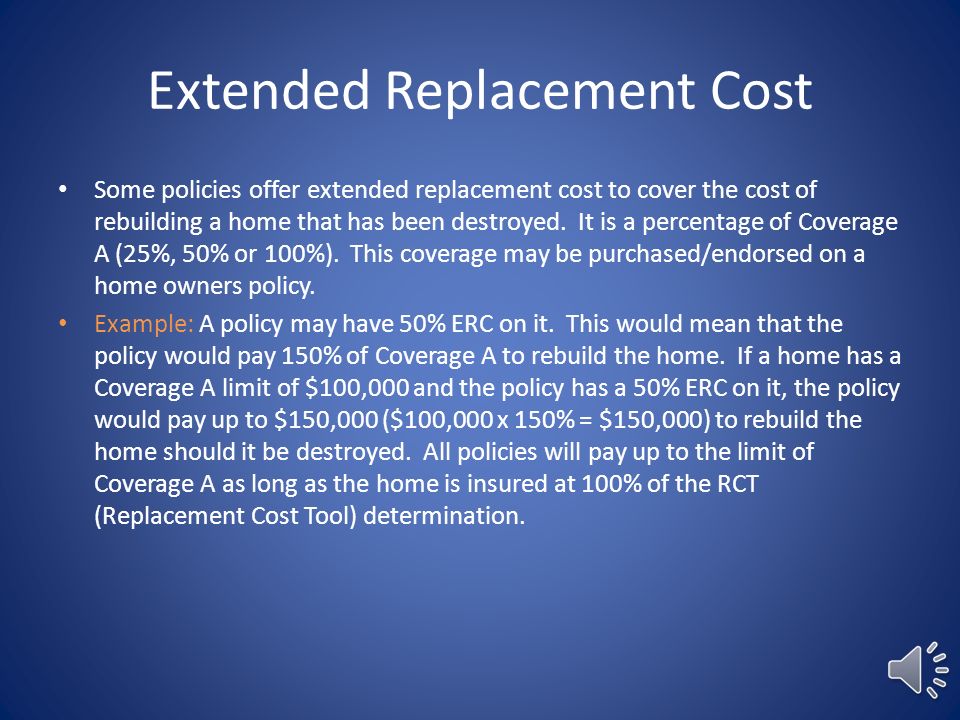

Extended and Guaranteed Replacement Cost Options

Some policies include Extended Replacement Cost Coverage, which adds a percentage (e.g., 20%-50%) to the policy limit if actual rebuilding costs exceed anticipated costs. Guaranteed Replacement Cost Coverage (if available) covers all rebuilding costs, regardless of how much they exceed the initial policy limit—however, this sort of coverage is uncommon and costly. In California for existing policy holders, Allstate Insurance offers their clients an Extended Replacement Policy of 150% of the policy limit. However, when deciding the policy value it is important to calculate the actual cost to replace the structure sometime in the future, so an annual adjustment might be necessary to keep up with inflation.

For example, a homeowner has $500,000 of replacement cost coverage. Following a blaze, construction expenses skyrocketed, and reconstructing the house now costs $600,000. If the insurance does not include extended coverage, the insurer will only pay $500,000, and the homeowner must pay the remaining $100,000. A replacement cost policy does not ensure complete rebuilding if the policy maximum is insufficient. Homeowners should examine and update their policy limits on a regular basis to ensure they are in line with current building expenses while also accounting for inflation and potential future calamities.

What Happens if Someone Walks Away from their Property Destroyed by Fire

There may be a number of financial and legal repercussions if someone leaves their home after it has been burned by wildfire in Los Angeles. This is what usually occurs:

1. Mortgage Obligation Doesn’t Go Away

The mortgage is still in effect even if the house is sold. The homeowner may still be liable for loan repayment if they lack adequate insurance coverage to cover the mortgage or rebuild.

2. The Procedure for Paying Out Insurance

If insured: If the losses are covered by the insurance company, the payout will typically go to the mortgage lender to settle the remaining amount. Any money left over could be given to the homeowner. The homeowner may have to pay the remaining mortgage debt out of pocket or look for financial aid if they are underinsured or uninsured. If they are granted some mortgage forgiveness there are also possible tax consequences to be dealt with.

3. The Risk of Foreclosure

Usually, the lender will start the foreclosure process if a homeowner stops paying their mortgage and leaves the property. The homeowner’s financial situation and credit score may suffer as a result. Before resorting to this drastic action, a homeowner should consult with counsel to discuss their options.

4. Possibility of a Deed in Lieu or Short Sale

In order to prevent foreclosure, some homeowners engage with lenders to negotiate a deed in lieu of foreclosure, in which the homeowner willingly gives the title to the lender, or a short sale, in which the property is sold for less than the remaining debt. There may also be tax consequences resulting from this process.

5. Disaster Relief & Government Assistance

Homeowners may be eligible for FEMA assistance, low-interest loans from the Small Business Administration (SBA), or mortgage forbearance alternatives through programs such as those provided by Freddie Mac and Fannie Mae in the event of a federally declared disaster. Anyone looking for alternatives should consult any and all of these available government programs.

6. Legal & Tax Repercussions

Any forgiven debt may be regarded as taxable income if the house is foreclosed upon or sells for less than the remaining mortgage amount. Legal action may result from leaving a property unattended without notifying the lender. Speaking with a tax attorney or CPA prior to resorting to this step is a prudent step.

California to Require Interest Paid on Insurance Funds Held in Escrow

Current California law provides, among other things, servicers or lenders must pay interest to borrowers on funds held in Escrow for the payment of property taxes and insurance premiums. This interest requirement does not currently apply to insurance proceeds the servicer or lender holds in escrow pending repair or rebuilding. New legislation introduced on February 10, 2025 (in light of the Los Angeles fires), would amend state law to require lenders and servicers to pay borrowers the interest earned on post-loss insurance proceeds.

What Will Cause the Greatest Challenge: Insurance, Mortgage or Rebuilding?

We’ve touched on the effects of the fire on homeowners. However, there are hundreds of renters that have been displaced by the Los Angeles fires as well. Property managers and property management companies have been burdened to help find their tenants’ replacement properties. Issues revolving around tenant personal property policies and property management insurance were not discussed but have significant consequences as well. The commercial property insurance policies that covered the businesses that lost their structures are also relevant and are being sifted through this mess. The entire calamity that encompasses the Los Angeles fires are much larger than the topic of homeowner and their insurance policies.

Lenders and servicers must exercise caution when communicating with all of the folks affected by the fires including borrowers. Deciding whether to apply insurance proceeds to the mortgage debt and determining short sale prices or credit bids in the event that loss mitigation is required. This is especially true given the legal complexity of property insurance, the standard mortgage clause, and Paragraph 5 of the uniform Deed of Trust, especially when combined with the extent of damage caused by the wildfires in Los Angeles and other statutory and regulatory considerations. These issues will be topics for years to come, but the Los Angeles fires have brought them to the forefront of the legal and insurance industries in 2025.

David currently is the broker/owner of several real estate related businesses which manage and maintain 300+ client properties on the San Francisco Peninsula.

Trust, transparency, and performance guarantees are the foundation of these businesses. David challenges anyone to find a PM professional that offers services similar - extensive education, customer service, and performance guarantees.

David also provides consulting for his clients on property development feasibility, construction, and complex real estate transactions.

David has authored a published law review article, three real estate books, and over 150+ real estate blog articles.

- “Wildfires, Insurance & Mortgages: Will Your Home Survive the Financial Aftermath?” - March 3, 2025

- What’s Driving California’s Commercial Real Estate Shakeup? - February 27, 2025

- Critical Issues in Triple Net Leases Investors Should Know - February 14, 2025