Previously in this blog we described a growing office-to-residential (OTR) trend in commercial real estate. It appears that the federal government has a serious interest in this trend as well.

In collaboration with federal agencies such as the Department of Housing and Urban Development (HUD) and the Department of Transportation (DOT), the White House has penned a strategy to encourage private sector involvement and participation in the crucial transformation of commercial office spaces into affordable housing. This initiative involves leveraging federal grants and offering financing at below-market rates to incentivize participation from private entities and commercial landlords.

Federal Deposit Insurance Corp. Chair Matin Gruenberg, in a recent address, highlighted the potential risks associated with past-due loans related to Commercial Real Estate (CRE), with a specific emphasis on office properties. This concern arises amid ongoing reports within the CRE industry regarding distressed real estate due to interest rates and a sluggish return-to-office (RTO) movement, particularly in urban office buildings. The current landscape for the urban office sector is marked by these challenges, occurring concurrently with a nationwide housing shortage, especially in the realm of affordable housing.

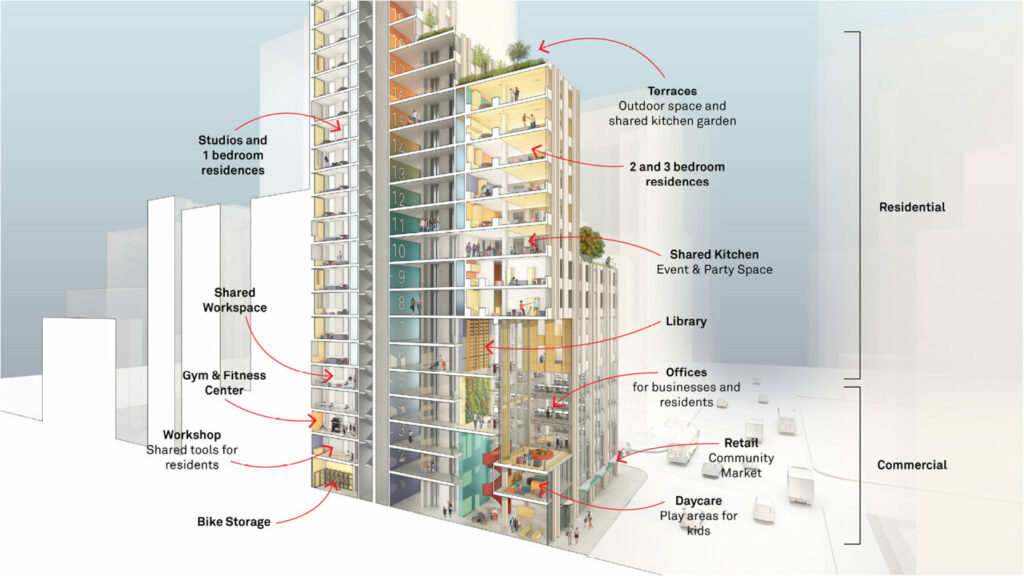

In response to this scenario, stakeholders in the Commercial Real Estate sector, including landlords, developers, lenders, commercial property managers, and other interested parties, have turned their attention to a seemingly straightforward solution: the conversion of unused or vacant office space into residential units. However, this transformation process is anything but simple; it is intricate, time-intensive, and comes with substantial costs.

Recognizing the complexities involved, the White House has introduced an initiative aimed at aligning with the shared objectives of providing affordable housing, encouraging the repurposing of underutilized commercial office spaces, and rejuvenating urban environments. While not a one-size-fits-all solution, this initiative represents a concerted federal/state effort to address the challenges faced by the urban office sector in contributing to the broader goals of housing accessibility and urban revitalization.

Overview of Federal OTR Involvement

The concept of “Office-to-Residential” (OTR) conversions is a shiny new object in the real estate universe. Potential OTR projects are capturing the interest of urban planners and public officials, with Los Angeles and Alexandria, Virginia emerging as leaders in this nationwide trend. In a proactive move, New York City unveiled its “Office Conversion Accelerator” program in August, leveraging zoning changes and expedited permitting processes to support OTR conversion projects. Following suit, Boston introduced a program in October, offering incentives for conversion projects through a comprehensive long-term tax abatement initiative (thinking outside the box).

The OTR conversion momentum has not gone unnoticed by the federal government. The White House has jumped on the bandwagon and recently released a guidebook, shedding light on various federal programs that can be harnessed to aid certain projects in transforming vacant office spaces into residential units. This high-level federal recognition underscores the growing significance of OTR conversions and the potential for collaboration between local and state initiatives and federal government resources.

Community Development Blocks Grants for OTR

Recently, the Department of Housing and Urban Development (HUD) issued a revised notice outlining the distribution of Community Development Block Grants (CDBG) earmarked for the acquisition, rehabilitation, and conversion of commercial properties into residential and mixed-use properties. These federal grants, available in the form of loans or outright grants, are disbursed to state and local governments, which, in turn, administer the funding. It is imperative for projects seeking CDBG support to adhere to statutory requirements on the books. This recent update signals the ongoing commitment of HUD to facilitate and incentivize the transformation of commercial spaces for residential and mixed-use purposes. Obviously, this OTR concept, because of its complexities and unknowns, will take a long-haul approach and hopefully will survive future administrations. See conditions and restrictions for CDBG support below:

Section 570.202(a) of the Code of Federal Regulations states in pertinent part:

(1) CDBG funding can only be allocated to projects that comply with “national objectives;”

(2) CDBG funding has limits for certain renovation projects if the applicant is a for-profit entity and is converting commercial space to residential (as opposed to remodeling of existing residential); and

(3) CDBG funds allocated to for-profit entities for commercial space conversion projects are limited to select activities such as (i) improvement of the exterior of the building, (ii) abatement of asbestos hazards, (iii) lead-based paint hazard evaluation and reduction, and (iv) the correction of code violations.

Transportation Infrastructure Finance and Innovation Act (TIFIA)

The Transportation Infrastructure Finance and Innovation Act (TIFIA) offers favorable financing options for qualifying OTR conversion projects falling under the category of Transit-Oriented Development (TOD). TOD encompasses initiatives aimed at expanding residential housing options within walking distance of public transit. TIFIA funding is accessible for projects with a minimum cost of $10 million and can be applied to a diverse range of OTR conversion expenses. TIFIA loans can cover up to 49% of eligible costs, featuring a fixed interest rate that closely aligns with the yield on comparable-maturity US Treasury securities. TIFIA has the capacity to directly extend loans to private entities and real estate developers, provided there is a public sponsor involved, like a local or state government. Both TIFIA loans and any senior debt must meet the investment-grade rating criteria. This financing avenue presents a valuable opportunity for developers and investors engaged in eligible Transit-Oriented Development conversion projects.

Department of Transportation: Railroad Rehabilitation and Improvement Financing Program

Another federal program is also available for OTR support. The Railroad Rehabilitation and Improvement Financing (RRIF) program offers attractive below-market financing options for the development of commercial-to-residential projects in close proximity to transportation centers. While RRIF eligible costs are somewhat more limited compared to those under TIFIA, they encompass similar activities. It is essential to note that, like TIFIA, RRIF exclusively supports Transit-Oriented Development (TOD) projects. TOD projects specifically designated for RRIF financing must meet additional requirements outlined by the Department of Transportation, described below.

RRIF loans provide a repayment period of up to 35 years, offering flexibility for developers engaged in long-term projects. Unlike some other financing programs, RRIF imposes no maximum or minimum project cost constraints. Up to 75% of eligible costs can be financed through a RRIF loan, providing a substantial financial resource for those involved in commercial-to-residential conversions near transportation hubs. This financing avenue represents a valuable opportunity for developers seeking cost-effective solutions for eligible TOD projects. RRIF programs also have conditions and restrictions described below.

Costs eligible for RRIF include: (a) construction, reconstruction, rehabilitation, replacement, and acquisition of real property, environmental mitigation, construction contingencies, and acquisition of equipment; and (b) capitalized interest necessary to meet market requirements, reasonably required reserve funds, capital issuance expenses, and other carrying costs during construction.

RRIF projects must: (i) incorporate private investment of greater than 20 percent of total project costs; (ii) be physically connected to, or is within ½ a mile of, a fixed guideway transit station, an intercity bus station, a passenger rail station, or multimodal station, provided that the location includes service by a railroad; (iii) demonstrate the ability of the applicant to commence the contracting process for construction not later than 90 days after the date on which the direct loan or loan guarantee is obligated for the project; and (iv) demonstrate the ability to generate new revenue for the relevant passenger rail station or service by increasing ridership, increasing tenant lease payments, or carrying out other activities that generate revenue exceeding costs.

Final Thoughts

Similar to other federal and governmental programs, it is crucial for commercial real estate professionals like developers, landlords and commercial property managers to familiarize themselves with the conditions and restrictions associated with initiatives such as those discussed. While these programs entail certain requirements, overlooking them would be a missed opportunity, as they can provide valuable resources that enhance the feasibility of the potentially costly endeavor of converting office spaces into residential units. By navigating and understanding the nuances of these programs, real estate practitioners can unlock valuable resources that contribute to the viability and success of office-to-residential conversion projects which in turn can help with the housing epidemic we currently face one project at a time.

In search of a trustworthy and professional commercial property management collaborator, Esquire Property Management Group exemplifies a continuing commitment to adhering to legal and ethical standards in the commercial property management sector. Importantly we understand the importance of being on the cutting edge of what is happening in the commercial real estate marketplace.

David currently is the broker/owner of several real estate related businesses which manage and maintain 300+ client properties on the San Francisco Peninsula.

Trust, transparency, and performance guarantees are the foundation of these businesses. David challenges anyone to find a PM professional that offers services similar - extensive education, customer service, and performance guarantees.

David also provides consulting for his clients on property development feasibility, construction, and complex real estate transactions.

David has authored a published law review article, three real estate books, and over 150+ real estate blog articles.

- “Wildfires, Insurance & Mortgages: Will Your Home Survive the Financial Aftermath?” - March 3, 2025

- What’s Driving California’s Commercial Real Estate Shakeup? - February 27, 2025

- Critical Issues in Triple Net Leases Investors Should Know - February 14, 2025