Legal Tax Deductions in Commercial Real Estate are Not Always Utilized

Owning commercial real estate can be highly lucrative, particularly when you utilize the numerous tax deductions legally available to property owners. These deductions can significantly lower your taxable income, increase cash flow, and enhance the profitability of your investments. While understanding the tax code can be complex, a well-informed strategy can yield substantial benefits. Below is a detailed guide to the key tax deductions available for commercial property owners.

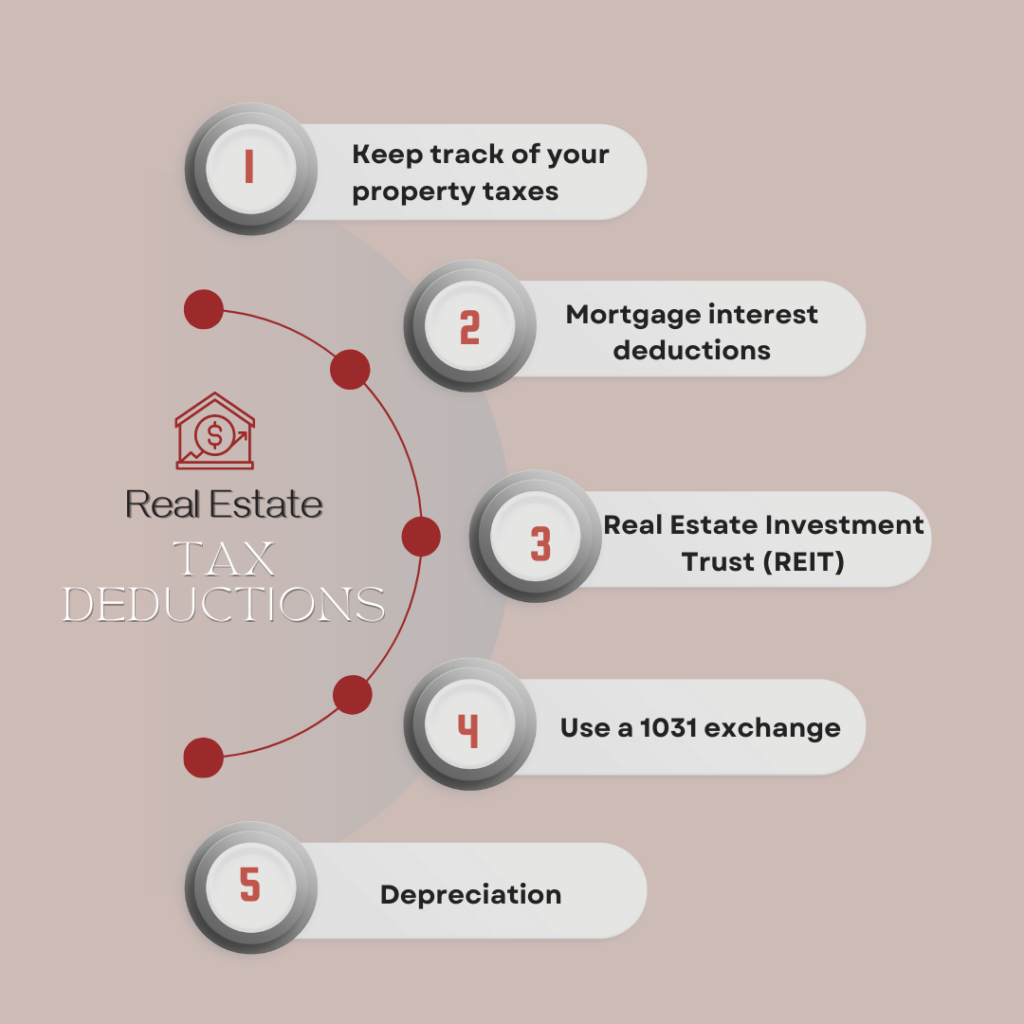

1. Depreciation: A Major Tax Advantage, but is it Fully Deductible?

One of the most valuable tax benefits in commercial real estate is depreciation, which allows investors to deduct the wear and tear of their buildings over time. For commercial properties, the IRS sets the useful life of the building at 39 years. This means you can divide the cost of the property (excluding land) into this period and claim an annual deduction.

For example, if a property’s building value is $1.2 million, the owner can deduct approximately $30,769 annually. Although this is a non-cash expense, it significantly reduces taxable income, preserving more capital for reinvestment.

What is Bonus Depreciation?

Recent tax reforms introduced accelerated deductions for certain property improvements. This means qualifying updates—such as HVAC installations, lighting systems, or security features—can often be deducted in full during the year they are made.

2. Are Interest on Commercial Real Estate Loans Fully Deductible?

The interest paid on loans used to purchase or improve commercial properties is fully deductible. This deduction is particularly impactful for properties with high financing costs. For example, if you pay $60,000 in interest annually on a commercial real estate loan, that entire amount can be subtracted from your taxable income.

Ensure the loan directly relates to the property to qualify for this deduction. This rule is especially relevant for refinanced loans or lines of credit.

3. Are Property Taxes Fully Deductible in CRE?

Local property taxes, assessed based on the property’s value, are fully deductible as an expense. Since tax rates vary by location, it’s vital to keep up-to-date records and make timely payments. Staying compliant with local tax authorities ensures you maximize this straightforward deduction.

4. Are All Routine Operating Costs Deductible?

Operating expenses necessary for managing your commercial property are fully deductible. Examples include:

- Utility bills like electricity, water, and gas.

- Insurance premiums for liability, property damage, and business interruption coverage.

- Repairs and maintenance, such as plumbing repairs, repainting, and HVAC servicing.

These costs are essential for maintaining tenant satisfaction and operational efficiency, making them critical to your overall strategy.

5. Which Professional Fees in CRE are Deductible?

Fees paid to accountants, property managers, legal advisors, and contractors involved in property upkeep and management are deductible. For example, if you spend $12,000 annually on property management services, this amount can be deducted as a necessary business expense.

6. Are All Advertising and Marketing Costs Fully Deductible?

Promoting your property to attract tenants is another deductible expense. Whether you’re paying for online listings, professional photography, signage, or digital ads, these costs fall under business expenses. Marketing investments not only ensure higher occupancy but also contribute to long-term profitability.

7. Employee Salaries and Benefits – All Fully Deductible?

If your property employs staff, such as maintenance workers, administrative assistants, or leasing agents, their wages and benefits (e.g., health insurance, retirement contributions) are fully deductible. These expenses are essential for large-scale properties with higher operational demands.

8. What are Deductibility Limits on Travel and Transportation Costs?

Property-related travel is another area where owners can claim deductions. This includes mileage for driving to properties, airfare for site visits, and hotel stays during business trips. Meticulous record-keeping is essential to claim these expenses, so maintain logs and receipts for all travel activities.

9. Are All Capital Improvements Expensable and Deductible?

While routine repairs are deductible, significant property upgrades—such as adding a new structure or installing elevators—are classified as capital improvements. These costs cannot be deducted in full during the year they occur but can be recovered over time through depreciation.

For instance, a new roof installation would qualify for depreciation but not immediate expense deduction.

10. Does the Net Operating Loss (NOL) Deduction Apply in All CRE?

If operating expenses or depreciation result in a loss for the year, these losses can often be carried forward to offset future taxable income. This is particularly useful during downturns when properties may experience higher vacancies or unexpected repair costs.

Conclusion

The U.S. tax code provides commercial real estate owners with numerous opportunities to optimize their financial performance through legal deductions. By understanding depreciation, interest deductions, operating expenses, and other tax-saving mechanisms, property owners can substantially enhance profitability. However, to navigate the complexities of these tax benefits effectively, it’s crucial to maintain accurate records and consult with a knowledgeable tax advisor. Doing so ensures compliance and maximizes the financial rewards of your commercial real estate investments.

In search of a professional commercial property management team which understands the importance of tracking your legally deductible expenses among other things, Esquire Property Management Group is a true professional organization that adheres to ethical and legal standards and fiduciary duties required by California law.

David currently is the broker/owner of several real estate related businesses which manage and maintain 300+ client properties on the San Francisco Peninsula.

Trust, transparency, and performance guarantees are the foundation of these businesses. David challenges anyone to find a PM professional that offers services similar - extensive education, customer service, and performance guarantees.

David also provides consulting for his clients on property development feasibility, construction, and complex real estate transactions.

David has authored a published law review article, three real estate books, and over 150+ real estate blog articles.

- “Wildfires, Insurance & Mortgages: Will Your Home Survive the Financial Aftermath?” - March 3, 2025

- What’s Driving California’s Commercial Real Estate Shakeup? - February 27, 2025

- Critical Issues in Triple Net Leases Investors Should Know - February 14, 2025