Have you heard the old legal adage, “[I]gnorance of the law is no excuse”? Many landlords and property owners consistently violate the law without knowing it, but that does not excuse their ignorance or their potential liability. One of the most common violations occurs when a tenant has resided in a property for more than one year – they are granted certain statutory rights which can’t be waived related to tenancy termination. California Civil Code Section 1946.1(b) states in pertinent part that:

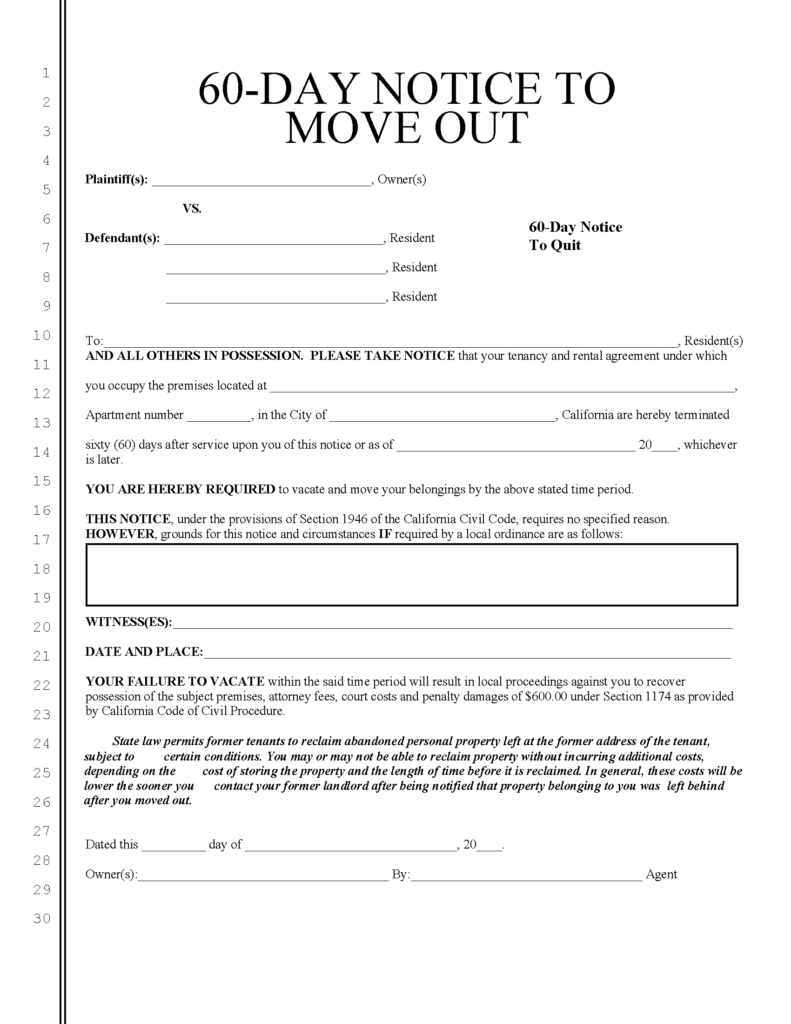

A landlord can end a periodic tenancy (for example, a month-to-month tenancy) by giving the tenant proper advance written notice. Your landlord must give you 60 days advance written notice that the tenancy will end if you and every other tenant or resident have lived in the rental unit for a year or more. This is known as the 60 Day Notice, which is a crucial aspect of tenant rights.

Many landlords and property owners have clauses in their rental agreements and leases that state “the landlord and tenant must give each other 30-day notice to terminate the tenancy.” The problem with this language is that it reduces the statutory minimum notice required by California Civil Code 1946.1(b), which mandates a 60 Day Notice for long-term tenants. Even if a tenant unknowingly agreed to such language in a rental agreement or lease they would not be bound by it because it is a statutory violation.

A landlord who violates this law may be subject to several penalties including a significant delay in getting the property back from the tenant. Moreover, landlords who violate the law can be subject to statutory remedies, fines, potential damages, and reasonable attorneys’ fees – if the tenant can prove such.

Understanding the 60 Day Notice in California

Many Non-Standard Leases & Rental Agreements are Non-Compliant and Can Subject Landlords and Property Owners to Liability

I’ve reviewed hundreds of leases and rental agreements over the years. The standard forms which are available from real estate services such as the California Association of Realtors are typically code and law compliant. Many forms just ‘placed’ on the internet are typically suspect and many times have clauses which violate either state or federal law. The common violations are reducing tenant’s statutory rights like the 60-Day Notice discussed above. Several others include a waiver of proper service of notice requirement, an increased amount of time a landlord or property owner has to return security deposits, and unlawful security deposit amount requests. Over the years I have seen many different violations but these are the common ones.

Professional Property Management Increases Return-On-Investment

Hiring a professional property manager can help make your investment a better return on investment, can reduce stress on the landlord/owner, and most importantly, make the investment decision a lucrative long-term asset building process seem like a good decision. Making the mistake of trying to manage the asset on your own can lead to costly mistakes, headaches, and even lawsuits as described above.

Professional Property Management Really Costs About 50% of the Stated Cost

Finally, professional property management fees are tax deductible for the asset owner which generally translates to about 50% real costs after taxes. So an 8% property management fee really only costs an owner approximately 4%. If you understand this math then hiring a professional property manager who is also a real estate attorney and gives free legal advice to their clients is a much bigger bargain – all for about the 4% real cost. If you have any questions about property management, property investment, tax strategies or basic real estate questions please don’t hesitate to contact me.

David currently is the broker/owner of several real estate related businesses which manage and maintain 300+ client properties on the San Francisco Peninsula.

Trust, transparency, and performance guarantees are the foundation of these businesses. David challenges anyone to find a PM professional that offers services similar - extensive education, customer service, and performance guarantees.

David also provides consulting for his clients on property development feasibility, construction, and complex real estate transactions.

David has authored a published law review article, three real estate books, and over 150+ real estate blog articles.

- “Wildfires, Insurance & Mortgages: Will Your Home Survive the Financial Aftermath?” - March 3, 2025

- What’s Driving California’s Commercial Real Estate Shakeup? - February 27, 2025

- Critical Issues in Triple Net Leases Investors Should Know - February 14, 2025