When buying an asset investment property, the most important decision is whether or not to hire a professional property manager to manage the property or to manage it yourself.

Most landlords have professional property managers manage their income or investment properties. It makes sense, correct? An investment property is a precious asset – just like 100,000 shares of a Fortune 500 company. Unless your profession is property management it is likely that you would not be as efficient or knowledgeable as someone who made property management their business.

Self-service property management appeals to a percentage of investors who see it as a way to improve their return-on-investment; typically an investor with a small portfolio of properties. The costs for taking the time to truly professionally manage an investment property can, over time, significantly outperform the returns. This is not a wise use of resources for several reasons.

Do-it-yourself landlords need to be willing to have their cell phones on 24-7. They need understand and identify the correct market rent for their property. They need to screen tenants for previous behaviors, not all of which can be detected unless they are educated in investigating tenants. They must conduct periodic inspections of the property and surrounding areas. They need to take care of all of the maintenance issues. They need to ensure rent is being paid on time and be capable of timely serving statutory notices to defaulting tenants. Finally, and most importantly, they need to be able to pull the trigger and evict bad tenants when the time comes.

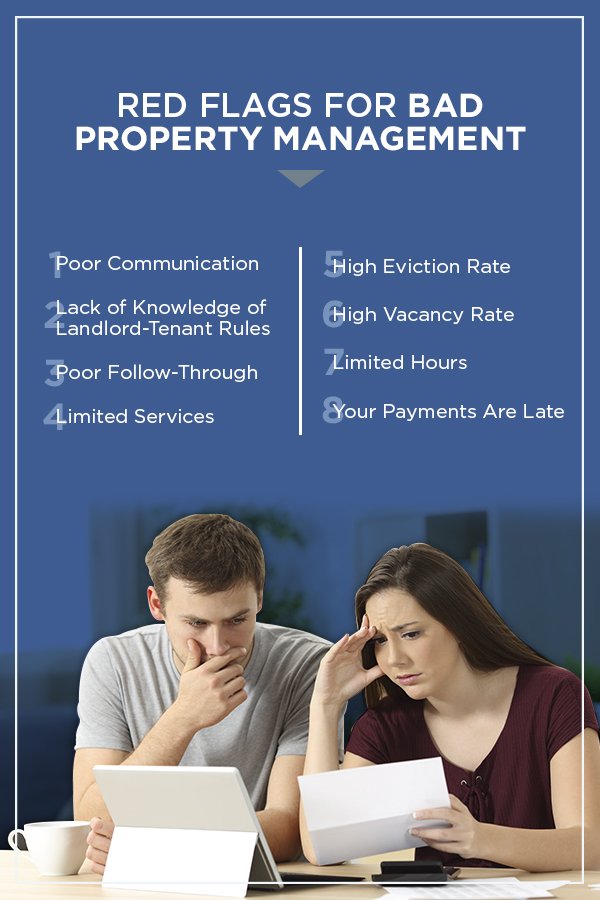

Failure to be proficient in these tasks can lead to all sorts of problems and a reduced return on investment.

For example, if a tenant is damaging the property and regular inspections are not held, the owner could be faced with mounting repair bills. If maintenance issues aren’t adjusted timely and a tenant injures themselves as a result, the owner could find themselves exposed to a lawsuit.

It is common knowledge that landlords/owners of investment property received higher returns and better overall rental yields when a professional property manager was hired. Importantly, investors and owners have better investment experiences overall when a professional manages the property.

Property and asset managers can provide landlords and owners with a buffer from several risk management pitfalls and help reduce potential loss for the landlord if an issue or problem develops.

Property managers are also charged with conducting regular property inspections to identify potential maintenance issues; they also keep an eye on the tenant to prevent issues with the property and, when required, engage the appropriate contractors timely to address any problems and issues.

Quality property managers maintain systems to quickly find and screen prospective tenants and/or renters. Most importantly professional property managers have direct access to databases that provide criminal history background checks for potential tenants; history of tenants who default on rent payments; and history of tenants who damage property and have a record of eviction.

Property managers confirm the proper contracts/leases are in place collects the all-important rent, monitor late payments, form a positive relationship with the tenant and regularly communicate with them.

If a dispute arises with the tenant, professional property managers will be familiar with the laws and are therefore able to follow the correct procedures to help resolve the problem as quickly as possible. Failure to follow the statutory notice requirements can cause lengthy delays in eviction, which ultimately leads to a reduced profitability for the property.

In essence a tenant can serve to wreck a landlord’s experience of owning a rental property if the landlord or owner has made mistakes in the management of the property. Finding good tenants and keeping them happy is THE best investment one can make. By helping tenants have a positive experience while residing at your property, they may be more likely to follow the lease by paying the rent on time, they are more likely to stay in the property longer and they may just treat the property as if it were their own.

Hiring a professional property manager can help make the investment have a better return on investment, can reduce stress on the landlord/owner, and most importantly, make the investment decision a lucrative long-term asset building process seem like a good decision.

David currently is the broker/owner of several real estate related businesses which manage and maintain 300+ client properties on the San Francisco Peninsula.

Trust, transparency, and performance guarantees are the foundation of these businesses. David challenges anyone to find a PM professional that offers services similar - extensive education, customer service, and performance guarantees.

David also provides consulting for his clients on property development feasibility, construction, and complex real estate transactions.

David has authored a published law review article, three real estate books, and over 150+ real estate blog articles.

- “Wildfires, Insurance & Mortgages: Will Your Home Survive the Financial Aftermath?” - March 3, 2025

- What’s Driving California’s Commercial Real Estate Shakeup? - February 27, 2025

- Critical Issues in Triple Net Leases Investors Should Know - February 14, 2025