A landlord who wishes to terminate a periodic (month-to-month) tenancy may do so by properly serving advanced written 30-day or 60-day notices on tenants. The operative word is properly. The reality is that most “mom and pop” landlords are on cruise control and don’t know the “ins and outs” of landlord-tenant law, namely California Civil Code section 1946 et. Seq. Over the years I defended many tenants who were improperly served by the landlord – the result of which was a delayed end of the tenancy. By failing to properly serve notice the landlord will be surprised when they find out (usually at the end of the 30 or 60 day period) that they need to re-serve the notice thus resetting the calendar for another 30 or 60 day period.

A landlord who wishes to terminate a periodic (month-to-month) tenancy may do so by properly serving advanced written 30-day or 60-day notices on tenants. The operative word is properly. The reality is that most “mom and pop” landlords are on cruise control and don’t know the “ins and outs” of landlord-tenant law, namely California Civil Code section 1946 et. Seq. Over the years I defended many tenants who were improperly served by the landlord – the result of which was a delayed end of the tenancy. By failing to properly serve notice the landlord will be surprised when they find out (usually at the end of the 30 or 60 day period) that they need to re-serve the notice thus resetting the calendar for another 30 or 60 day period.

What Does “Properly Serve” Mean?

The terms “serve” and “service” and “service of process” are all legal procedural terms. These procedures are designed to increase the likelihood and probability that the person to whom notice is given actually receives the notice. If a person is not served properly they have not been provided all of the protections the law allows, namely due process which is a constitutional guarantee. Any landlord who brings an eviction action against a tenant must prove that the tenant was properly served – and if they were not then the landlord’s case gets dismissed and they must start anew with a new service of notice, etc.

Ignorance is Bliss

Ignorance is Bliss

Many landlords and property owners unknowingly violate the law because of a lack of education. A common violation occurs when a landlord attempts to terminate a tenancy by serving either a 30-day notice (for tenants who have been in a leasehold for less than one year), and a 60-day notice (for tenants who have been in the property longer than one year). Many unknowing landlords send communications to their tenants via email. They get complacent with the email communications and they mistakenly believe that an email is a proper method of communication for service of notices – when in fact it is not. Moreover, just mailing a notice via U.S. mail is not a proper method of service. California Code of Civil Procedure 1162 et. Seq. and California Civil Code 1162 et. Seq. specifies the four (4) methods of proper service of notices:

- Personal Service – actually handing the document to the tenant by someone who is at least 18 years old and can testify to that effect;

- Substituted Service – if the tenant can’t be found service of the notice can be made on a person of “suitable age and discretion” at the tenant’s home or work and a copy of the notice mailed to the tenant’s address;

- Posting and Mailing – Notice may be posted on the leasehold door with tape or tack and a copy mailed to the leasehold address; and

- Registered or Certified Mail and Return Receipt Requested – The landlord may send notice by registered and certified mail with return receipt requested – the receipt will prove service.

Tenants Suffer by their Landlord’s Lack of Education

Tenants Suffer by their Landlord’s Lack of Education

Uneducated tenants who are subject to landlords who violate the law are at a disadvantage and more often than not will have their rights violated. A landlord who fails to properly serve notices, and gets caught, will cause themselves significant delay in getting the property back from the tenant – so a two-month waiting period could be effectively doubled.

Many “Mom & Pop” Rental Agreements are Illegal and Can Subject Landlords to Liability

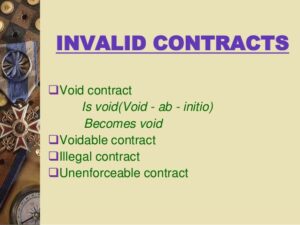

Over the years I’ve reviewed dozens and dozens of leases – many of which are illegal and void ab initio. Many of these “internet” forms have clauses which violate tenant’s rights. Standard forms found with associations like the California Association of Realtors are code compliant and should be used.

P rofessional Property Management Reduces Likelihood of Violations

rofessional Property Management Reduces Likelihood of Violations

A professional property manager on your team can dramatically improve your return on investment. The mistake many people make is trying to do it on their own which can lead to costly mistakes, headaches, and even lawsuits as described above – all of which cost the owner money and effectively reduces their return on investment.

Professional Property Management Fees Are Less than You Think

Professional property management fees are a business expense. These expenses are tax deductible for the property owner which will effectively provide a real cost of management fees which are significantly less. All investment property owners should consider hiring a professional property manager to help them manage their properties. If you have any questions about property management, tax strategies, basic real estate questions and property investment please don’t hesitate to contact me and ask me why it makes sense to have a real estate attorney manage your properties for you.

David currently is the broker/owner of several real estate related businesses which manage and maintain 300+ client properties on the San Francisco Peninsula.

Trust, transparency, and performance guarantees are the foundation of these businesses. David challenges anyone to find a PM professional that offers services similar - extensive education, customer service, and performance guarantees.

David also provides consulting for his clients on property development feasibility, construction, and complex real estate transactions.

David has authored a published law review article, two real estate books, and over 120 real estate blog articles.

- What is Driving the Growing Demand for Enhanced Electrical Capacity in Residential and Commercial Buildings? - November 25, 2024

- What Are All the Legal Tax Deductions in Commercial Real Estate (CRE)? - November 17, 2024

- What are Typical Commercial Property Management Fees? - November 15, 2024