A Guide for Baby Boomers: Maximize Your Home Equity and Avoid Capital Gains Taxes

As many Baby Boomers look to downsize from their homes, they face a significant challenge: how to sell their properties without losing a substantial portion of their hard-earned equity to capital gains taxes. Fortunately, there are strategies available, thanks to provisions in U.S. tax law that can help homeowners protect their investments.

The Downsizing Dilemma – How to Avoid Paying Capital Gains Taxes

For many retirees, the desire to move to a more manageable, single-level home is strong. However, the equity accumulated over decades in their current homes can lead to hefty capital gains taxes upon sale. For example, a married couple selling a home with $2 million in unprotected equity might face over $760,000 in capital gains taxes, even with the tax exclusion benefits available.

Understanding the Tax Code: The Key Provisions

Internal Revenue Code Section 121: The Exclusion

Under IRC Section 121, homeowners can exclude up to $500,000 in capital gains from the sale of their primary residence (or $250,000 for single filers) if they have lived in it for at least two of the last five years. This exclusion does not apply to vacation or investment properties, making it crucial to understand its implications for your primary residence.

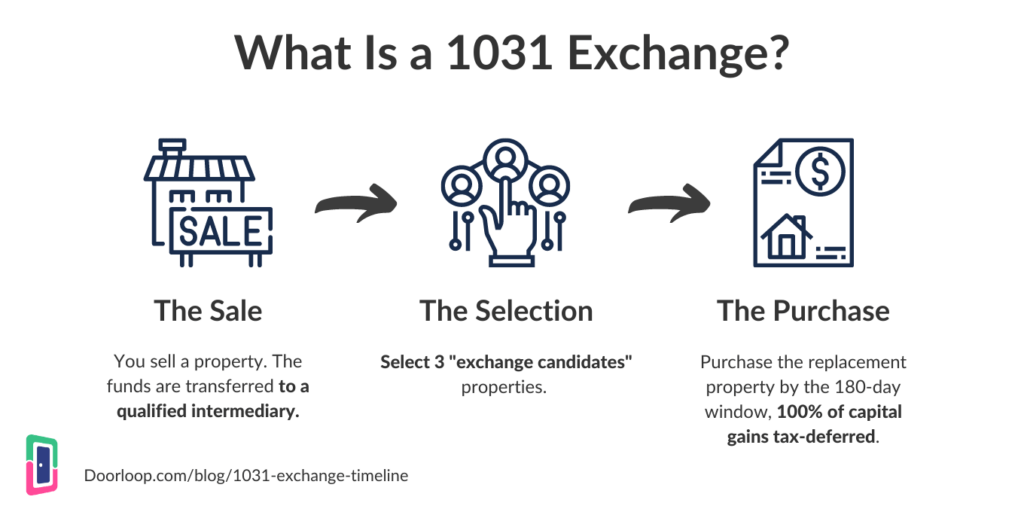

Internal Revenue Code Section 1031: The Exchange & Avoid Capital Gains Taxes

IRC Section 1031 allows homeowners to defer capital gains taxes by exchanging investment properties for other like-kind properties. While this provision doesn’t apply to primary residences directly, it can be leveraged if a primary residence is converted to a rental property.

Combining Strategies for Optimal Results

By skillfully combining Sections 121 and 1031, homeowners can significantly mitigate or even eliminate capital gains taxes.

Three Key Strategies

- Convert a Rental Property to a Primary Residence (No prior 1031 Exchange): After living in an investment/rental property for at least two years, homeowners can take advantage of the Section 121 exclusion when selling it. There is a one-time exclusion from capital gains tax of $500,000 for married couples or $250,000 for single filers – that’s right, this otherwise taxable gain is put right in your pocket at the time your sell your residence – provided you’ve met the criteria.

- Convert a Rental Property Previously Acquired Through a 1031 Exchange: If you’ve used a 1031 exchange to acquire a rental property, you must live there for five years to qualify for Section 121, but you only need to occupy it for two of the last five years before selling.

- Convert Your Primary Residence into a Rental Property – Golden Strategy: By moving out of your primary residence and renting it for at least a year, you can later sell it as an investment property, potentially benefiting from both Section 121 and 1031. This approach allows you to defer taxes and retain equity. Make sure to hire a professional property management service to help lease and maintain your property.

Addressing Your Living Situation

When considering these strategies, many people ask where they will live during the transition. The answer is simple: you can use the rental income from your former primary residence to rent a new home during the “curing” period. This could range from a single-level condo to a cozy rental in a desirable neighborhood.

Investing 1031 Exchange Proceeds

As for what to do with the proceeds from a 1031 exchange, consider investing in commercial or mixed-use properties, multi-family properties, commercial properties such as bank buildings, etc. Such investments often yield stable rental income, helping you cover costs while maximizing returns.

Step-by-Step Action Plan

- Assess your home equity.

- Convert your primary residence to a rental for at least a year.

- Find a rental home for yourself using the income from your converted property.

- After a year, sell the rental property, applying the Section 121 exclusion.

- Use a 1031 exchange to invest in a new property.

- Identify your replacement property within 45 days and close within 180 days of the sale.

- Decide whether to continue renting or move into your new investment property.

- Plan for long-term asset retention within your family.

Conclusion

For many Baby Boomers in the Bay Area and beyond, these strategies provide an effective means to downsize while preserving wealth. Understanding and utilizing the tools available in the tax code can empower you to achieve your downsizing goals without incurring capital gains taxes.

If you have questions or need assistance navigating this process, feel free to reach out. We’re here to help you make the most of your investment.

We also encourage you to reach out to your CPA or tax advisor for their input and guidance regarding any tax advise, or strategy before you move forward.

David currently is the broker/owner of several real estate related businesses which manage and maintain 300+ client properties on the San Francisco Peninsula.

Trust, transparency, and performance guarantees are the foundation of these businesses. David challenges anyone to find a PM professional that offers services similar - extensive education, customer service, and performance guarantees.

David also provides consulting for his clients on property development feasibility, construction, and complex real estate transactions.

David has authored a published law review article, three real estate books, and over 150+ real estate blog articles.

- “Wildfires, Insurance & Mortgages: Will Your Home Survive the Financial Aftermath?” - March 3, 2025

- What’s Driving California’s Commercial Real Estate Shakeup? - February 27, 2025

- Critical Issues in Triple Net Leases Investors Should Know - February 14, 2025