When evaluating a commercial property to understand its value, the desirability, the real numbers, one has to research the property and perform some level of due diligence. It is important to conduct thorough market research and analysis to understand the local economy and real estate market. Also, Conduct some preliminary research at the city planning and/or building department to see if there are any plans for development in proximity to your potential investment which could impact value.

When looking at a potential investment you must not rely on the seller’s marketing brochures, or believe the listing broker’s word or proformas prepared by the seller’s advocates – you have to do your own homework.

The following are some key terms and concepts that will help you evaluate and perform due diligence. You will also need 2-3 years of the actual operating documents, the existing leases, estoppel certificates, and any other material information about the condition of the building(s) and any surrounding neighborhood issues to fully understand the investment.

Commercial Property Definitions

Effective Gross Income

To calculate Effective Gross Income, we subtract Vacancy from Gross Income:

Effective Gross Income equals Income minus (Vacancy Rate Percentage x Income)

Gross Income

Gross Income is all of the income received at a given property, including rents, laundry and vending money, late fees, etc. on a monthly or annual basis.

Gross Potential Income

Gross Potential Income (GPI) commonly describes to the total rental income an investment property can produce if all available units are fully leased at market rents which provides a zero vacancy rate. Gross Potential Income can also be referred to as potential gross income, gross scheduled income, or gross potential rent, but each person can use their own description as there are not hard and fast rules.

Net Present Value (NPV) is the difference between the present value of cash inflows (income coming into the property) and the present value of cash outflows (expenses) over a period of time. NPV is frequently used by real estate investors in capital budgeting and investment planning to analyze the potential or real profitability of a projected commercial property investment or project. NPV is the result of detailed calculations used to find today’s value of a future stream of payments – assumptions are necessary.

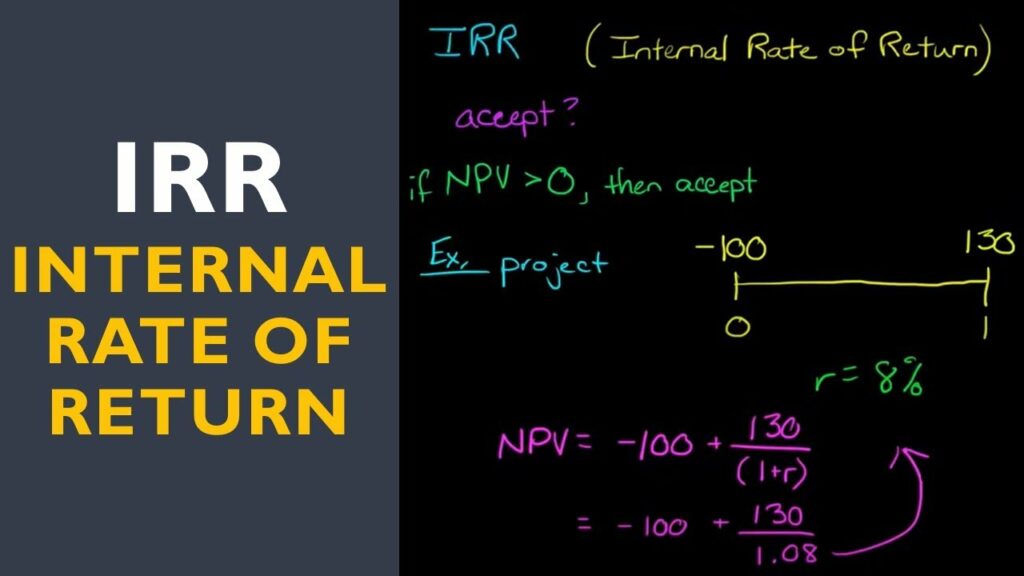

Internal Rate of Return (IRR) is an important commercial real estate metric/calculation utilized in due diligence financial analysis to approximate the probable profitability of contemplated real estate investments. IRR can be technically described as a discount rate (or interest rate) that makes the Net Present Value (NPV) of all future cash flows equal to zero in a discounted cash flow analysis – this is a complex formula that is used in sophisticated financial analyses of investment properties. Even though this is an important analysis to help you determine the viability of an investment there are assumptions you must make, specifically with future cash flows. In order to make these assumptions you need to use information gleaned from the seller and/or their listing broker.

IRR calculations basically rely on the same formula as the Net Present Value (NPV) formula does. IRR is not the actual dollar value that you will earn on the project investment, it is the annual return that makes the NPV equal to zero which helps you determine whether or not the project is a good investment.

To be clear, all things being equal, correct, and stable, the higher the IRR, the more desirable an investment should be. IRR calculation is uniform for investments of varying types and can be used to compare multiple prospective investments on a level playing field. In short, the investment with the most positive IRR probably would be considered the best return for your money.

Net Operating Income (NOI)

One’s Net Operating Income (NOI) is the Effective Gross Income minus Operating Expenses.

Net Operating Income = Effective Gross Income minus Operating Expenses

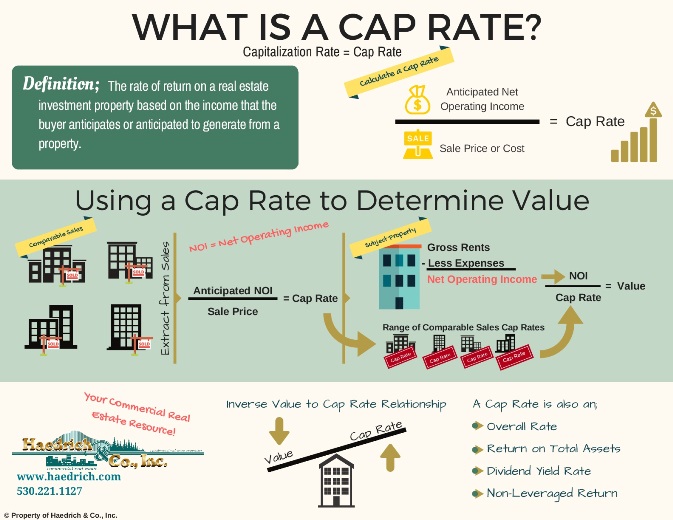

Cap Rate

Capitalization Rate (or cap rate) is commonly defined as the Net Operating Income divided by the Sales Price. Cap rate is the measure of profitability of an investment. A similar term commonly used in stocks and bonds is rate of return. Cap rates describe how much one would make on an investment if you paid all cash, thus, financing and taxes are not included.

Cap Rate = Net Operating Income divided by Sales Price

Cash Flow

Annual Cash Flow is Net Operating Income minus Debt Service. One can also figure monthly cash flow by dividing the annual cash flow by 12:

Annual Cash Flow = Net Operating Income minus Debt Service

Monthly Cash Flow = Annual Cash Flow divided by 12 months

Cash-on-Cash Return

To find cash-on-cash return, divide annual cash flow by the down payment amount:

Cash-on-Cash Return = Annual Cash Flow divided by Down Payment

Debt Service

Debt Service is calculated by multiplying your monthly mortgage amount by 12 months plus any other fees associated with the mortgage:

Debt Service = Monthly Mortgage Amount x 12 months

Operating Expenses

Annual Operating Expenses of the property typically include taxes, utilities, insurance, management fees, payroll, landscaping, maintenance, supplies and repairs. Mortgage and interest expenses are not included here.

Vacancy

Vacancy is any unit that’s left unoccupied and isn’t producing income.

Vacancy Rate

Vacancy Rate is the number of vacancies divided by the number of units:

Vacancy Rate = Amount of vacancies / Number of units

Commercial Property Investments as Compared to Other Investments

Commercial property investments (including retail, office, warehouse, and REITs) can offer several potential advantages over other types of investments. One of the main advantages is the potential for steady cash flow through rental income. Additionally, commercial properties can appreciate in value over time, providing the potential for capital appreciation. These investments can continue to have increasing rental income, can have favorable tax benefits, and also provide a vehicle for borrowing against the value. However, commercial property investments also have their own set of risks, among other things, such as fluctuations in the real estate market, and the need for significant upfront capital and ongoing expenses for property maintenance and management. These investments also require more extensive due diligence and research compared to other investments such as stocks or bonds. Overall, the returns on commercial property investments can be attractive (taken including all the potential benefits), but they are also more illiquid and require a long-term investment horizon.

Commercial Property Investments as Compared to Stock Market

Over the last 50 years, the stock market, as represented by the S&P 500 index, has provided an average pre-tax annual return of approximately 8%. In comparison, commercial real estate has provided an average annual return of approximately 8-9% depending on the geographical location (i.e., San Francisco has performed better than Des Moines). However, it’s important to note that these returns are not directly comparable as the stock market and commercial real estate investments have different risk profiles and characteristics.

Additionally, the stock market tends to be more liquid and can be more easily bought and sold, while commercial real estate is generally considered to be a more illiquid investment. The stock market also tends to be more affected by macroeconomic factors such as interest rates and GDP growth, while commercial real estate is more affected by local factors such as supply and demand in the specific market where the property is located.

In terms of volatility, commercial real estate investments tend to be less volatile compared to stock market investments, but they also tend to be less responsive to market conditions. Also, most commercial property owners cannot possibly “panic” sell their property, whereas stock and bond holders can click a button and poof their investment is sold in a microsecond.

In the last five decades the stock market has provided comparable returns to commercial real estate, but it also comes with higher volatility and liquidity. Moreover, stock market investments don’t have all the benefits that we described for commercial property in the Introduction (Four Ways You Make Money with Commercial Real Estate). Commercial real estate investments also provide more stability and less volatility but also less liquidity. It’s also important to note that commercial real estate investments have a higher correlation with inflation, making them a good hedge against inflation.

Commercial Property Investments as Compared to Bond Market

Since 1970, the bond market has provided an average annual return of around 5-6%. This is lower than the stock market, but also comes with lower volatility and less risk. In comparison, commercial real estate has provided an average annual return of around 8-9%. It is important to note that commercial real estate returns are not directly comparable to bond market returns, as the two asset classes have different risk profiles and characteristics.

Bonds are a relatively stable and low-risk investment, as they are generally issued by stable entities such as governments and large corporations, and the returns are usually fixed. In contrast, commercial real estate investments are generally considered to be higher risk, as they are affected by a variety of factors such as fluctuations in the real estate market, economic conditions, and local supply and demand.

In terms of liquidity, bonds tend to be more liquid than commercial real estate, as they can be easily bought and sold on the bond market. Commercial real estate, on the other hand, is generally considered to be a more illiquid investment.

Commercial Property Investments as Compared to Residential Property Market

Since the late 1960s and early 1970s, the residential real estate market has provided a national average annual return of around 4-5% – this again depends on where your residential property is located (some regions have significantly outperformed this average). This return is lower than the commercial real estate market, which has provided an average annual return of around 8-9%. However, it is important to note that returns from the residential and commercial real estate markets are not directly comparable as the two markets have different characteristics and risk profiles.

Residential properties are a more stable investment as they are less affected by fluctuations in the economy and local market conditions. Additionally, residential properties are a less risky investment as the demand for housing is usually relatively stable. On the other hand, commercial properties are a higher risk investment, as the demand for commercial properties can be affected by a variety of factors such as economic conditions, interest rates, inflation, business environment, and local supply and demand.

In terms of liquidity, residential properties tend to be more liquid than commercial properties, as they can be easily bought and sold on the residential property market. Commercial properties, on the other hand, are generally considered to be a more illiquid investment as they can sometimes take months if not years to sell on the open market.

Commercial Property Investments as Compared to Commodities and Precious Metals Market

Since 1970, the commodity market has provided an average annual return of around 4-6%. Additionally, precious metal investments such as gold and silver have provided an average annual return of around 5-6%. These returns are both lower than the commercial real estate market, which has provided an average annual return of around 8-9%. However, it is important to note that returns from these markets and commercial real estate markets are not directly comparable as the two markets have different characteristics and risk profiles.

Commodities and precious metals are a more volatile and risky investment as the prices of commodities and metals are subject to fluctuations based on global supply and demand, weather conditions, geopolitical events and other factors. In contrast, commercial real estate is a more stable investment as it is less affected by fluctuations in the economy and local market conditions.

In terms of liquidity, commodities and precious metals can be bought and sold on various markets like the London Metal Exchange, NYMEX and others, which provide a good level of liquidity.

Commercial Property Investments are Unique Investments

Some quick comparisons above show that commercial property investments do well against other market investments, but one must consider that real property investments have the added benefits of capital equity appreciation, rental income increases, debt destruction, depreciation for tax benefits, and the asset itself used as a source for loans. The other market investments do not provide those benefits.

As always a sophisticated investor will maintain a diversified portfolio that includes investments in all asset classes is by far the most prudent course of conduct that will bode well in the long term. If you decide to invest in a commercial property please consider to have seasoned experts help you in the process including a professional property management service like www.esqmpg.com.

David currently is the broker/owner of several real estate related businesses which manage and maintain 300+ client properties on the San Francisco Peninsula.

Trust, transparency, and performance guarantees are the foundation of these businesses. David challenges anyone to find a PM professional that offers services similar - extensive education, customer service, and performance guarantees.

David also provides consulting for his clients on property development feasibility, construction, and complex real estate transactions.

David has authored a published law review article, three real estate books, and over 150+ real estate blog articles.

- “Wildfires, Insurance & Mortgages: Will Your Home Survive the Financial Aftermath?” - March 3, 2025

- What’s Driving California’s Commercial Real Estate Shakeup? - February 27, 2025

- Critical Issues in Triple Net Leases Investors Should Know - February 14, 2025